Not all the member franchiSORS that advertise through the IFA should be selling franchises.

Franchise Grade put out a report that accentuates the importance of looking at franchisors’ net growth, not just number of franchised outlets opened, to understand a particular franchiSOR’S actual viability.

Franchise Grade collected data on 2,489 franchiSORS. Then, they calculated the net growth in number of outlets opened for each franchiSOR by dividing the percentage of new outlets opened by the percentage of outlets closed between 2010 and 2018.

Pretty smart, eh?

This little calculation allowed Franchise Grade to get straight to the crux of the matter.

Net growth rates give potential new investors information about how many outlets are opening in comparison to how many outlets are closing. That’s pretty dang important information if you’re considering investing everything you have in a franchise because you’ve been told it’s a “proven business model.” A franchiSOR that’s closing anywhere close to many outlets as it’s opening isn’t proving that they’ve got a business you’d want to risk everything on — and mind you, in signing a franchise agreement, you’re risking everything.

Yet, according to Franchise Grade, “A lack of analysis of net growth rates creates an unforeseen risk for potential franchisees. Although this risk isn’t typically identified or raised as a concern, it impacts the overall success and reputation of the franchise industry across every sector.”

FranchiSEES are the largest investors in the franchise industry. Yet they’re not receiving the information they need before they invest and the result has been disastrous for the viability of franchising. If you weren’t previously aware that the reputation of franchising is poor, be aware now.

My opinion is that right now, congress needs to address these problems. I wouldn’t consider investing until they get things cleaned up. The Fair Franchise Act of 2017, for example, has a clause that states it would only affect agreements signed after the Act was passed. That Act never got off the ground, but one might in the near future. If it does, you want to make your investment afterwards.

WHAT IT’S LIKE BEFORE YOU SIGN A FRANCHISE AGREEMENT vs. WHAT IT’S LIKE AFTER YOU SIGN A FRANCHISE AGREEMENT:

Franchise Grade‘s calculations allowed them to assess the viability of the 2,489 franciSORs in their index.

They report that of the 2,489 franchiSORS:

- 654 or about 26% had a net growth rate of 80% or more.

- 217 or about 9% had a net growth rate between 0% and 30%

- 665 or about 27% had a negative net growth rate or a growth rate below zero!

Doing some simple subtraction, that means that 953 or about 38% of the franchiSORS in their index had net growth rate of between 30 and 80%. That’s not particularly passable. Yuck!

Arguably, nobody should be willing to invest anything in a franchise with a net growth rate of less than 80%. This means that roughly 74% of the franchiSORS in the Franchise Grade index aren’t worth purchasing, especially considering the fact that purchasing them means signing a personal guarantee and initialing ALL CAPS statements that revoke one’s rights.

For the sake of brevity, I am going to focus this post on a couple worst-case scenarios. This decision on my part should not be generalized to mean that all cases are as bad as these examples. That said, these cases do prove that the IFA is supporting investments that very likely could ultimately leave unsuspecting and trusting investors homeless (remember those personal guarantees!) while simultaneously lining the franchiSORs and the IFA’s pockets.

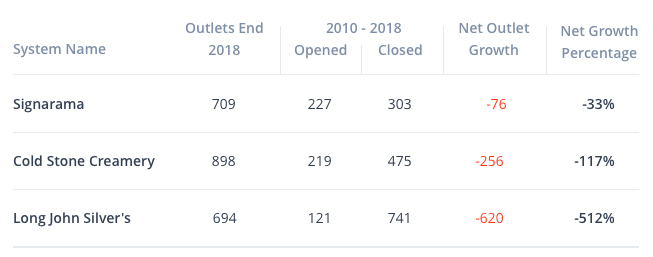

Among the franchiSORS with negative growth rates were at least three household names as highlighted by the Franchise Grade: Signarama, Cold Stone Creamery, and Long John Silver’s.

Yet despite these franchiSORS’ poor performance, both Long John Silver’s (with a whopping net growth rate of -512%!!!) and Signarama (-33%) are members of the International Franchise Association and are advertised for sale on the IFA website!

The franchiSEES, however, don’t fare as well as the IFA and the franchiSORS, especially if they don’t purchase a viable franchise system. They lose their franchise fee, all of their initial investment and very possibly their home because they signed a personal guarantee.

Let’s think, for a second, about the amount of money in initial investments franchiSEES spent on Long John Silver’s and Signarama between 2010 and 2018 using the numbers offered us by Franchise Grade.

Even though Long John Silver’s had a negative net growth rate of -512% and closed 714 franchise locations, they kept right on selling. They opened 121 new locations and for each location, according the the IFA website, each franchiSEE investor spent between $600,000 and $800,000. Using $700,000 as a round middle figure, that works out to be a franchiSEE investment of $84,700,000 in Long John Silver’s alone.

Signarama opened 227 new outlets during the same years despite their negative net growth rate of -33%. With a total investment of between $168,000 and $172,000 new franchiSEES invested $38,590,000 on a business that probably should have been shutting its doors.

Other, non-franchised businesses, most likely would have done just that… they would have shut their doors because the business owners wouldn’t have wanted to continue losing their own money.

Long John Silver’s and Signarama are apparently past their prime. Time to stop putting up new shingles using somebody else’s money folks!

But since Long John Silver’s and Signarama are franchised businesses, most of their capital comes from franchiSEE investors. Fear of personal loss doesn’t incentivize poorly performing franchiSORS to stop expanding. FranchiSORS with negative net growth rates can still make money off of franchise sales —- even if selling means their franchiSEE investors could lose millions and millions of dollars.

And in 2017, all three franchiSORS with negative net growth rates highlighted by the Franchise Grade (Long John Silver’s, Signarama and Cold Stone Creamery) were on the SBA directory. They were eligible for taxpayer-backed SBA loans.

But keep this in mind: taxpayer costs fall on the shoulders of the middle and upper-middle class collectively. FranchiSEE investors might have lost everything. Many likely defaulted on their loans and depending on what was in their franchise agreements regarding future royalties due, the franchiSORS might have even been able to use the courts to take their homes claiming the franchiSEES “failed” (in the franchiSORS’ failing systems, mind you).

That’s about the size of it folks. The franchise industry is in crisis. Don’t buy a franchise.

And don’t be too surprised that the International Franchise Association is lobbying against transparency that would protect taxpayers.