On August 15, 2018, the SBA Office of the Inspector General drew a conclusion that could damn the franchise industry.

The conclusion comes at the end of a report that states it is “the first in a series” of “future reports.”

The SBA is uncovering the fraud. FranchiSEES are organizing and speaking. And at least one current congresswoman understands the problem and has introduced a bill to the Senate.

It’s too bad the franchiSORS are so well hooked up in Washington D.C. and are whispering into other congresspeople’s ears. The banks don’t deserve this continual bailout.

Franchise fraud is bigger than SBA lenders getting into cahoots with franchiSORS and writing bad loans. Many franchiSEES are defrauded in the industry without SBA involvement, but the involvement of SBA Preferred Lenders cuts right to the chase.

And it can be documented and stopped.

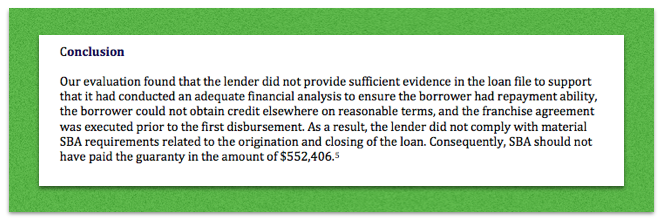

From a financial perspective, the Office of the Inspector General’s conclusion that the “SBA should not have paid the guarantee in the amount of $552.406” might mark the end of the fraud.

If the SBA decided to not pay just one wrongful taxpayer-backed guarantee, the decision would reverberate through the entire system.

SBA Preferred Lenders would stop making bad loans against the rules of the SBA Standard Operating Procedures if the SBA stopped paying the guarantees.

And why should they pay the guarantees? The report’s conclusion states, “Our evaluation found that the lender did not provide sufficient evidence in the loan file to support that it had conducted and adequate financial analysis to ensure the borrower had repayment ability.”

Er… lenders’ documents need to be in place. Otherwise, why should the taxpayer be paying guarantees for borrowers who “could not obtain credit elsewhere on reasonable terms”?

The report states that “The lender did not comply with material SBA requirements related to the origination and closing of the loan.”

So the lender is at fault.

So, no, the public shouldn’t be paying the guarantees to support the fraud.

Why are taxpayers supporting banks’ devious and malicious practices? Good, hard-working franchiSEES who trust(ed) the government are losing everything.

The SBA needs to hold the lenders accountable and stop paying guarantees that weren’t earned and aren’t deserved.